Discover How Consumers Interact with Digital Media in the Area

ABOUT THIS STUDY

- It is intended to give business leaders and marketing decision makers a perspective into the consumer digital media landscape in the West Palm Beach DMA

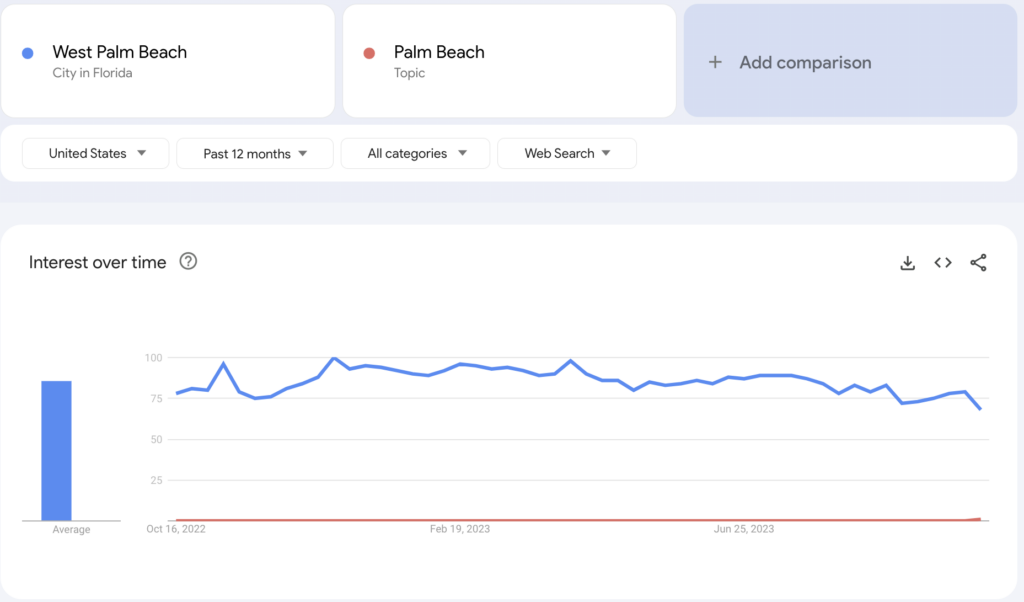

- It spans the past 12 months – from October, 2022 to October, 2023: This is a critical note because West Palm, Palm Beach and the County at-large continue to have a large seasonal component – so the fact we studied one entire “season,” and one entire “off-season” gives as accurate a picture as possible as to daily life over a 12 month span

- It analyzes the major media outlets, cultural touchstones and lifestyle destinations shaping the daily experience of consumers in the market

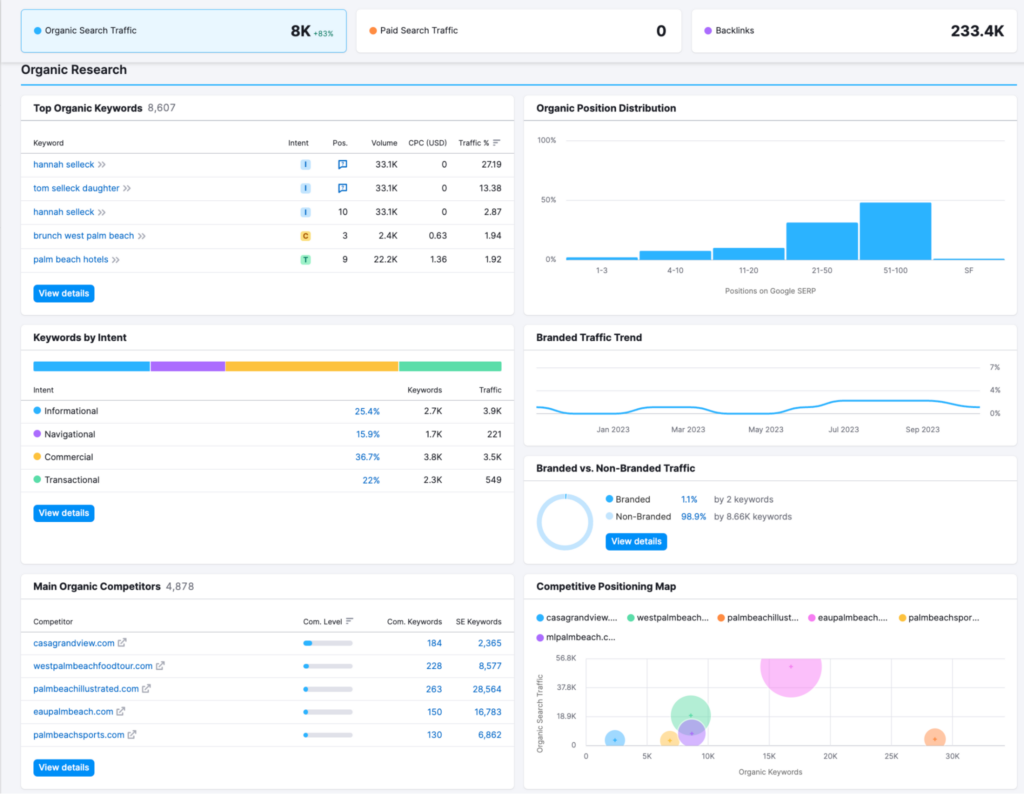

- It uses a combination of publicly available 3rd party and proprietary 1st party data

- Sources: SEMRush, RivalIQ, Google Trends and more

- It is independently developed by Lincoln Digital Group; there are no sponsors or underwriters

KEY ORGANIZATIONS STUDIED

- WPTV (Channel 5)

- The Palm Beach Post (PBP)

- WPEC (Channel 12)

- PB Illustrated

- PB Daily News (The Shiny Sheet)

- ML Palm Beach

- The Norton

- The Square

- The Royal

- The Kravis Center

A PRIMER ON THE AREA

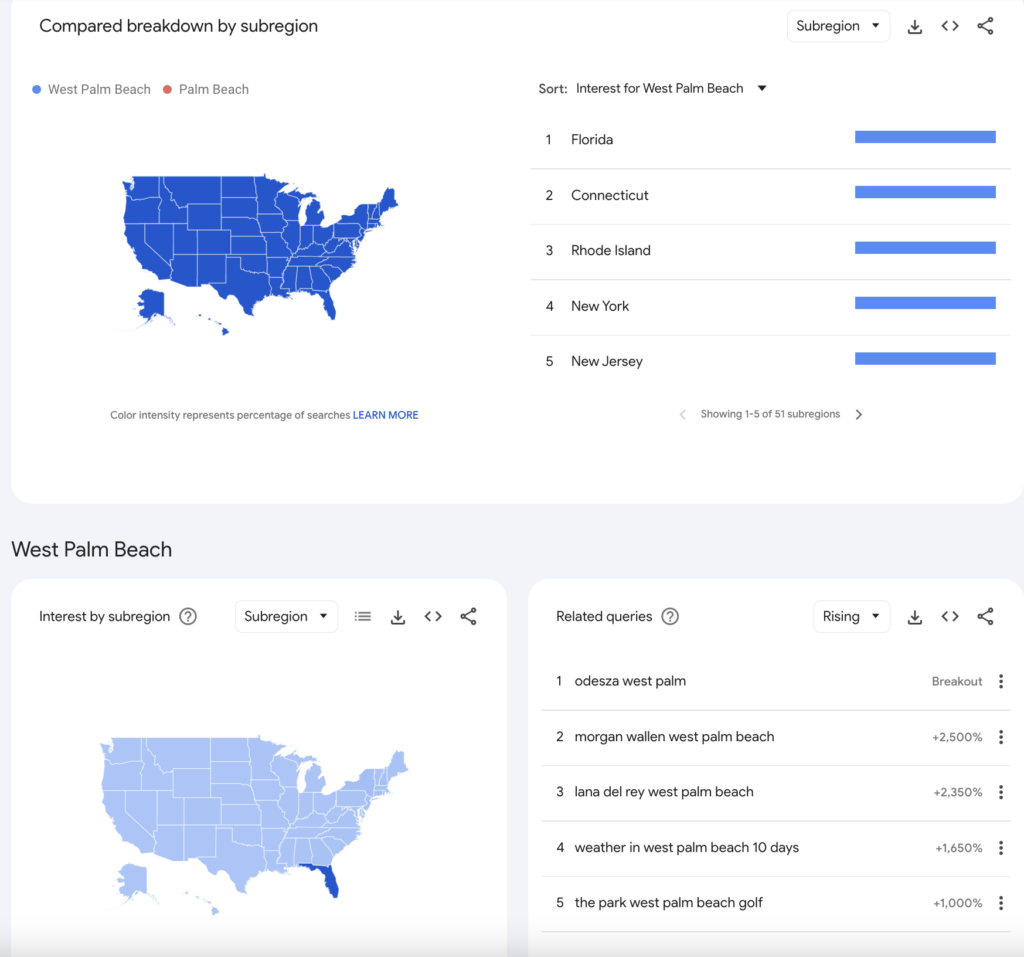

Contrary to some misconception, West Palm =/= Palm Beach

- Locals know what Google searches show: There’s a wide gap between the two municipalities

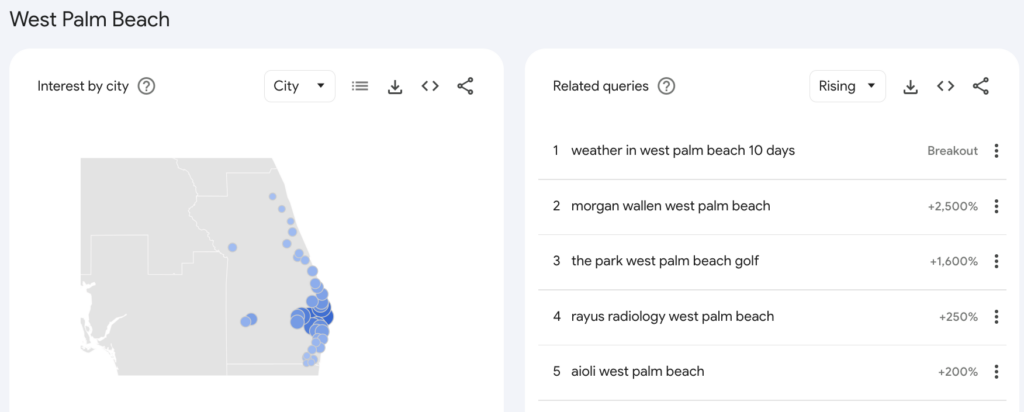

West Palm is heavily driven by Northeastern influence…and the opportunity outdoor sports and entertainment…

- Concerts, weather and golf dominate top search terms

Using Google for local businesses is not unusual, but affinity this strong is…

- See #4 and #5

THE AUDIENCE

They care more about what you sell than who you are (at least online)…

Two-thirds of all websites that serve West Palm Beach consumers in our study had these as their most trafficked pages, in this order:

- Homepage.

- An offering page (everything from suits to paintings to fitness classes in our study).

- About.

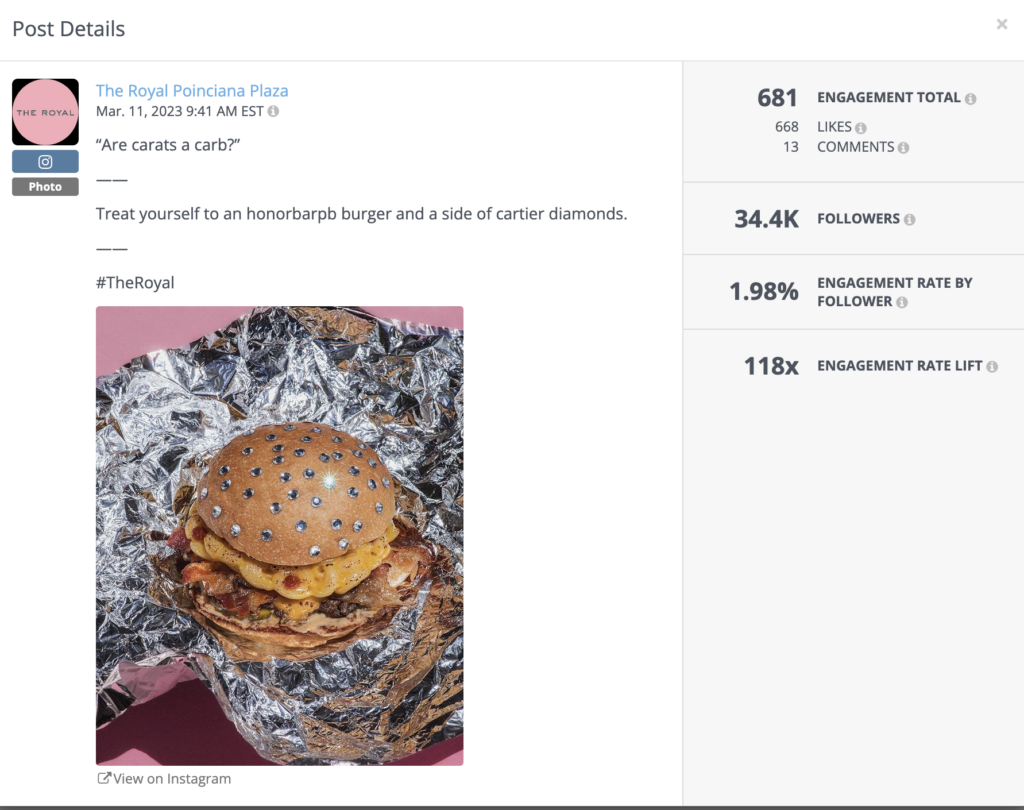

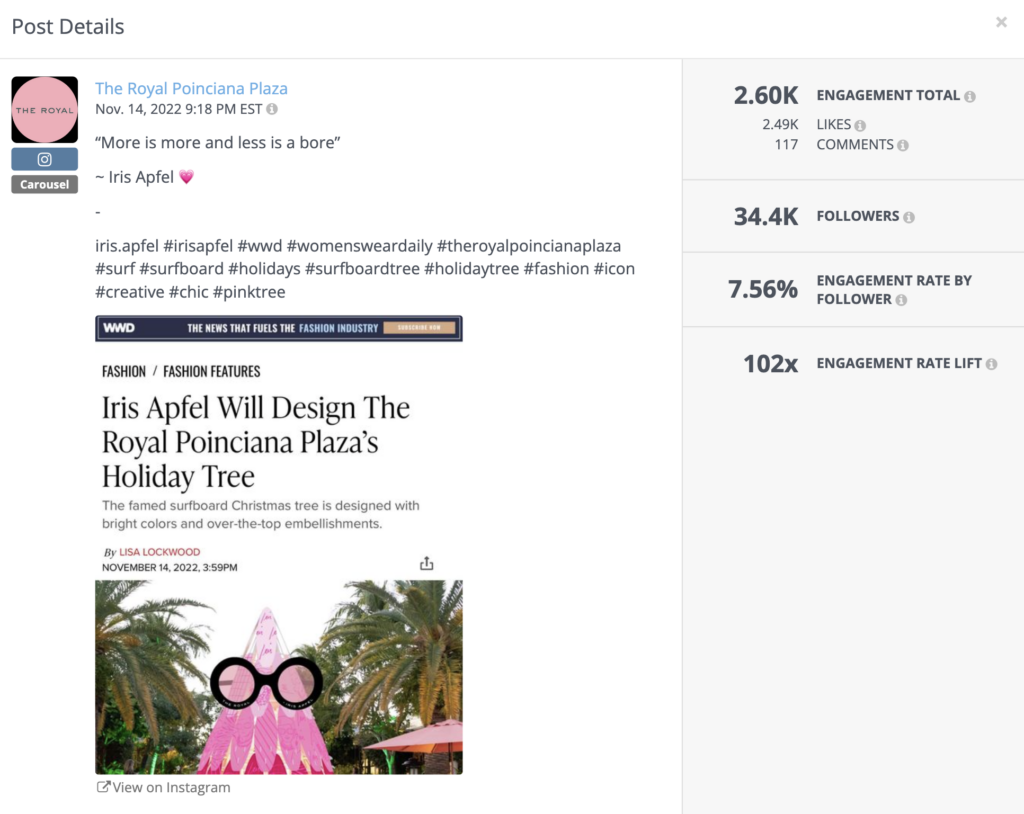

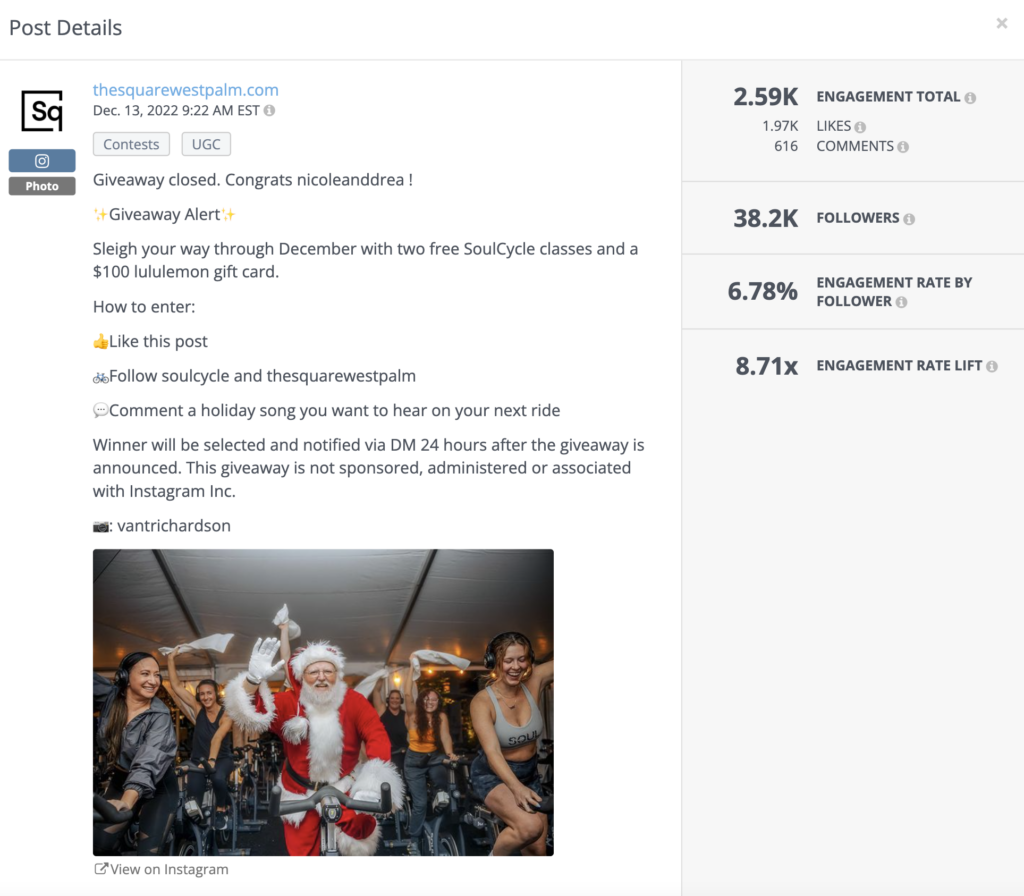

…and have a passion for great design, the holidays, and diamonds (on our burger)…

You want locals’ attention? All it takes is designer Christmas trees, Santa giveaways, diamonds and the Easter bunny.

These are the best performing social media posts by significant area accounts over the past 12 months.

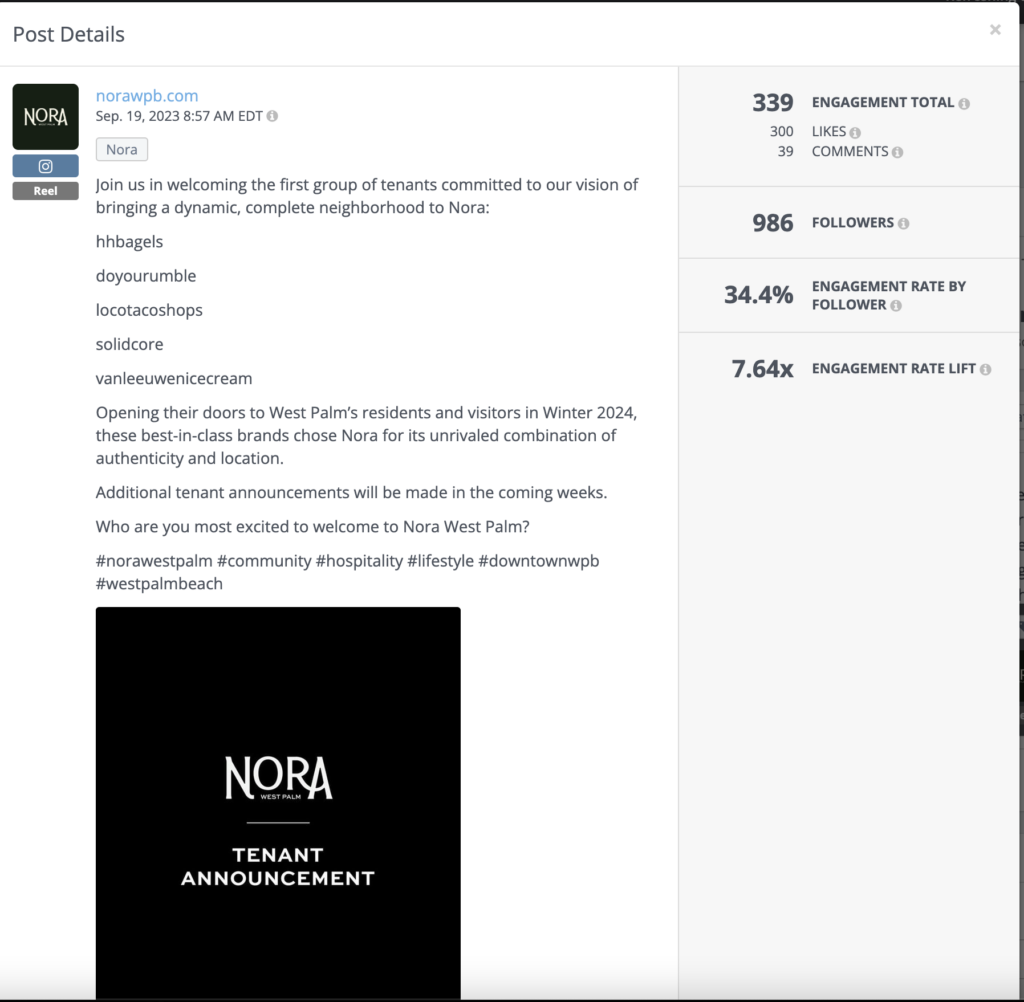

…they’re dialed into Nora…

Four posts from the forthcoming adaptive re-use development — including groundbreaking and the first tenant announcement video – have audince engagement rates (ie. likes/comments/shares) above 25%. This is more than four times Instagram’s stated average of 4.2%.

LOCAL MEDIA

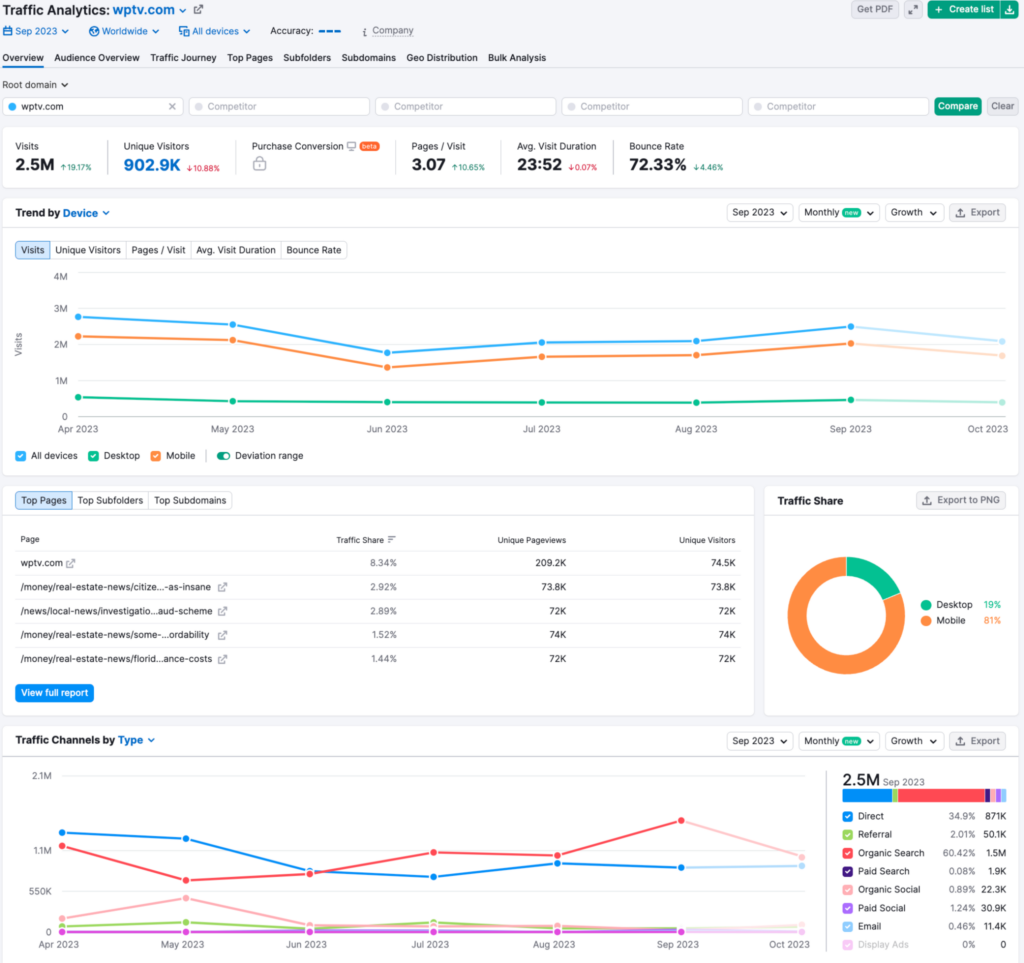

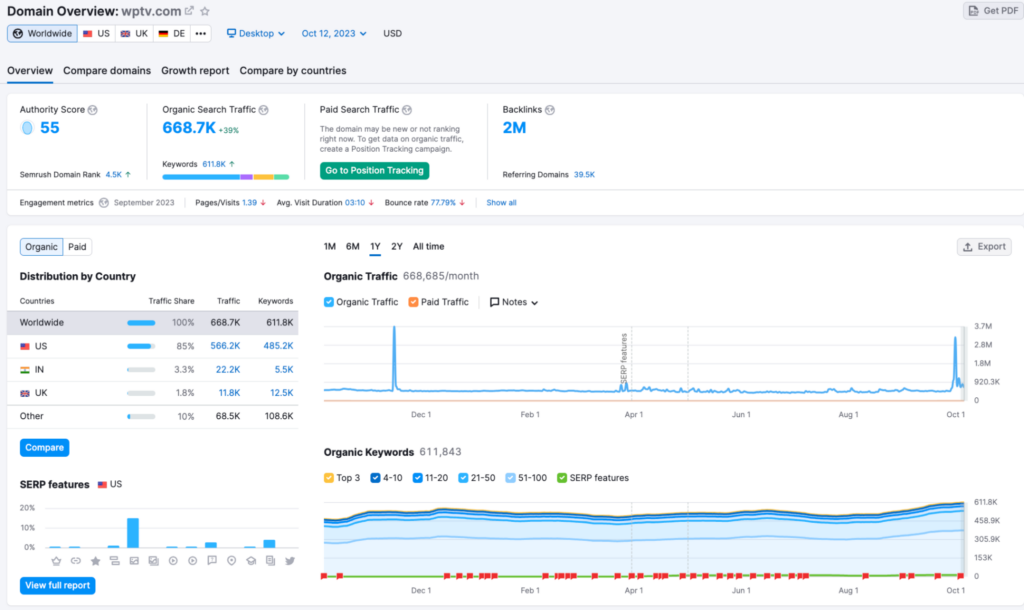

WPTV is the online news leader (with weather and real estate issues to thank)…

- Tied with PBP for total traffic (2.5MM users/mo.)

- A highly engaged audience, with nearly 25 mins spent on site, and more than 200% better than PBP on average pages per visit

- Nearly half of the unique visitors of PBP

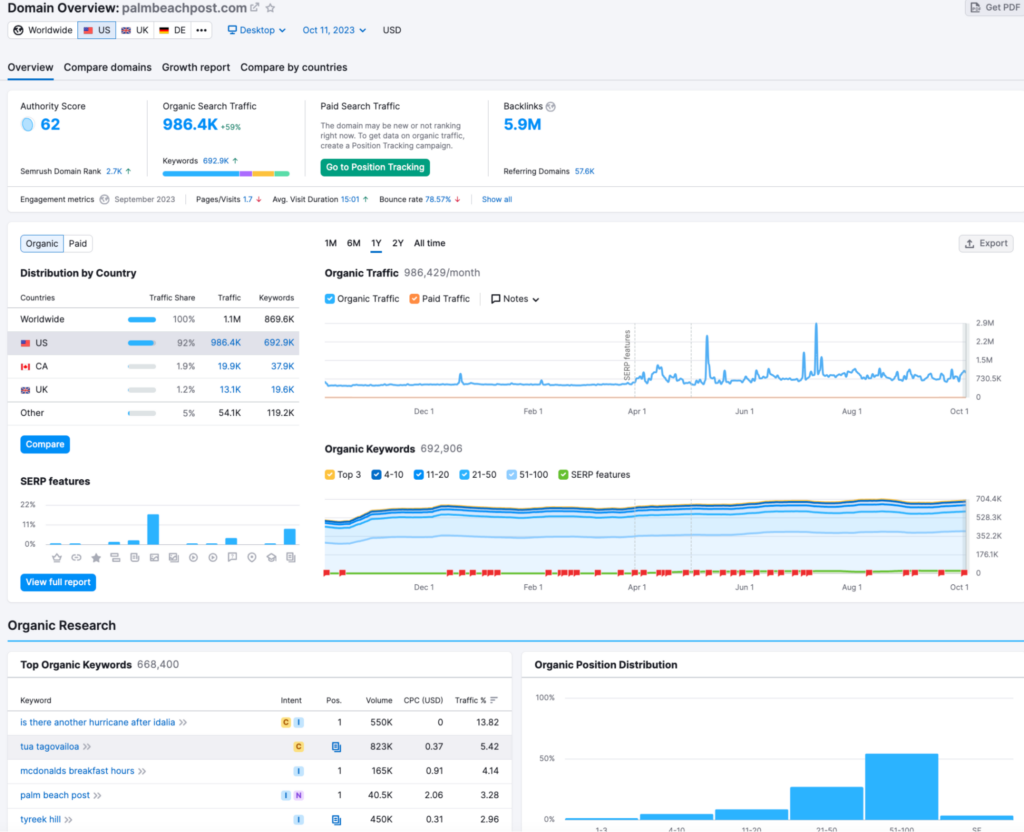

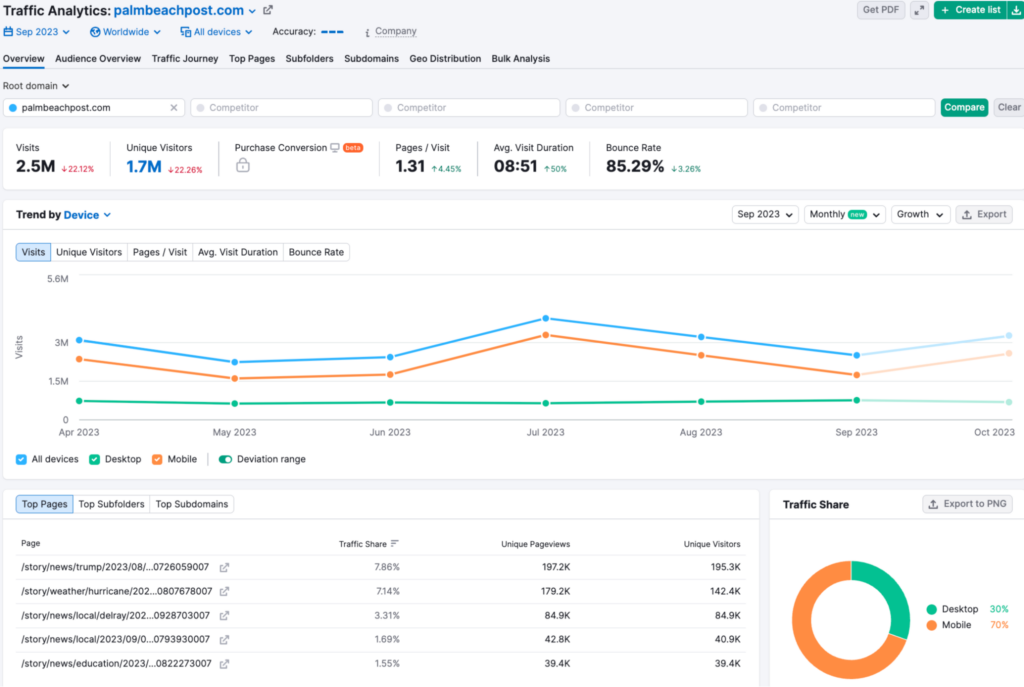

…but The Palm Beach Post is more vibrant lately…

- The Dolphins move the needle on audience behavior

- A less engaged audience than WPTV, spending 9 minutes per visit compared to 25

…with users that behave more like legacy media viewers…

- Roughly two-times the monthly unique visitors of WPTV

- Greater percentage of desktop users than WPTV

- More engagement from political, education and local news issues than WPTV

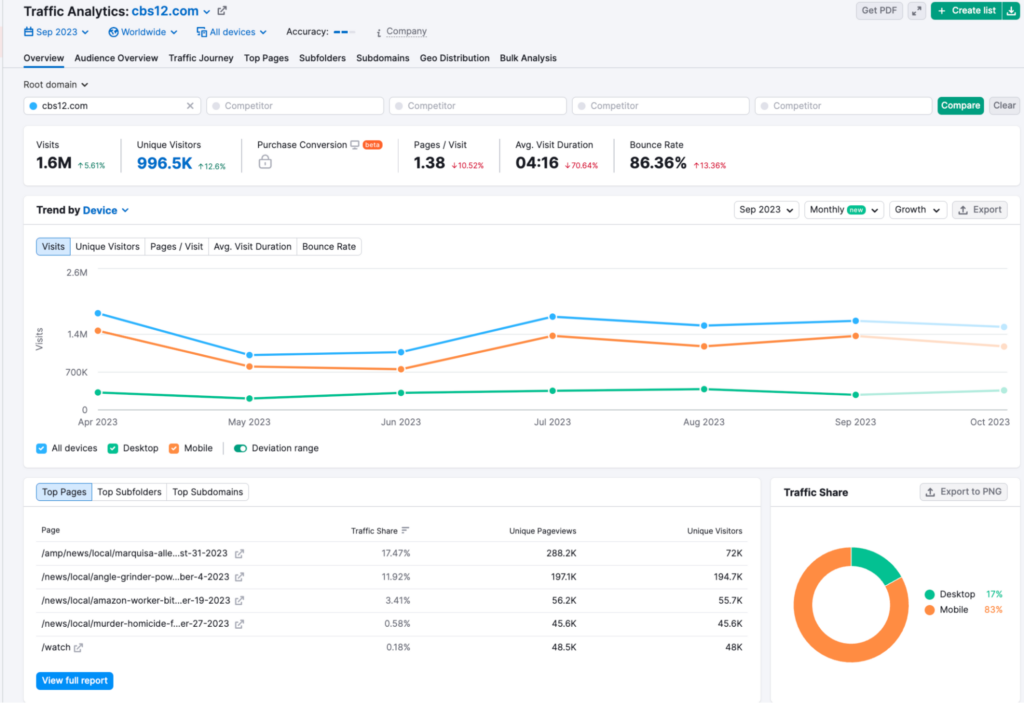

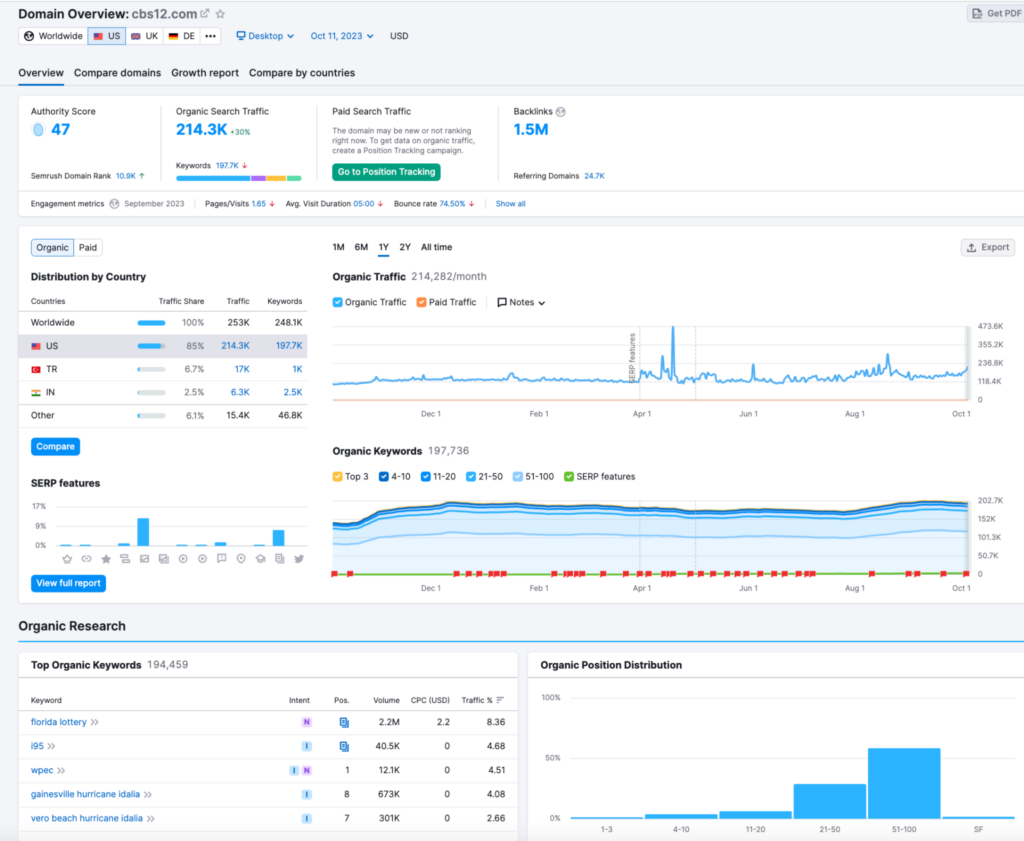

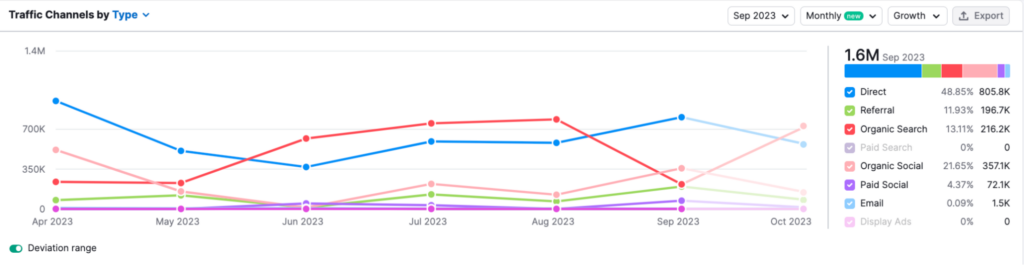

WPEC: Strong in search across devices, but a less engaged audience than its peers

WPEC: Acquiring its web audience from a divserse mix of channels

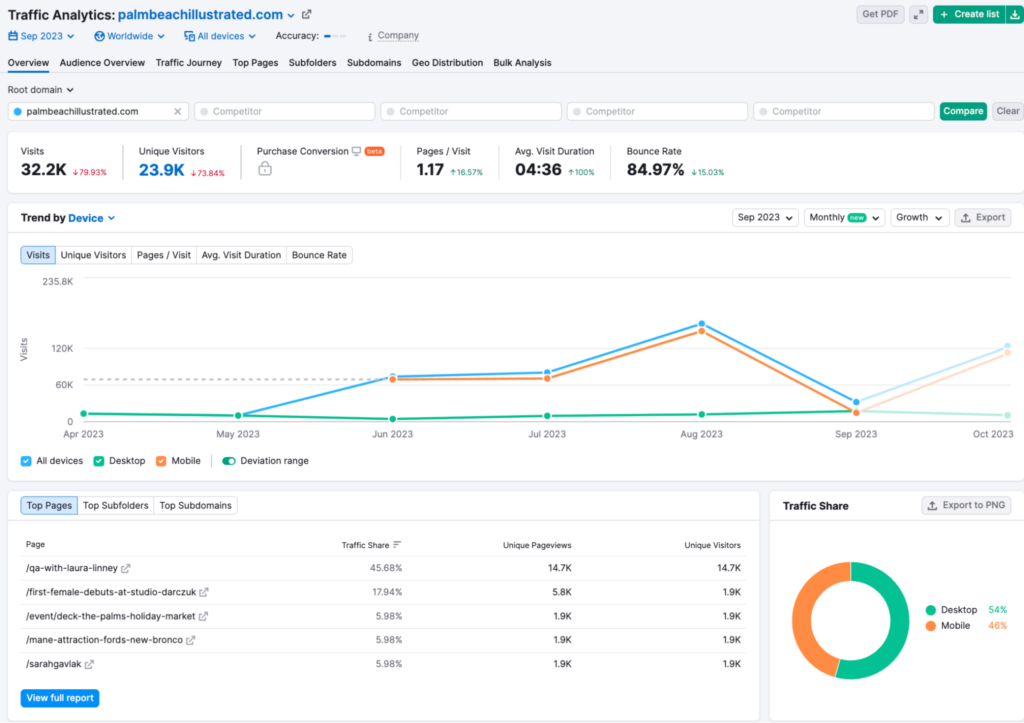

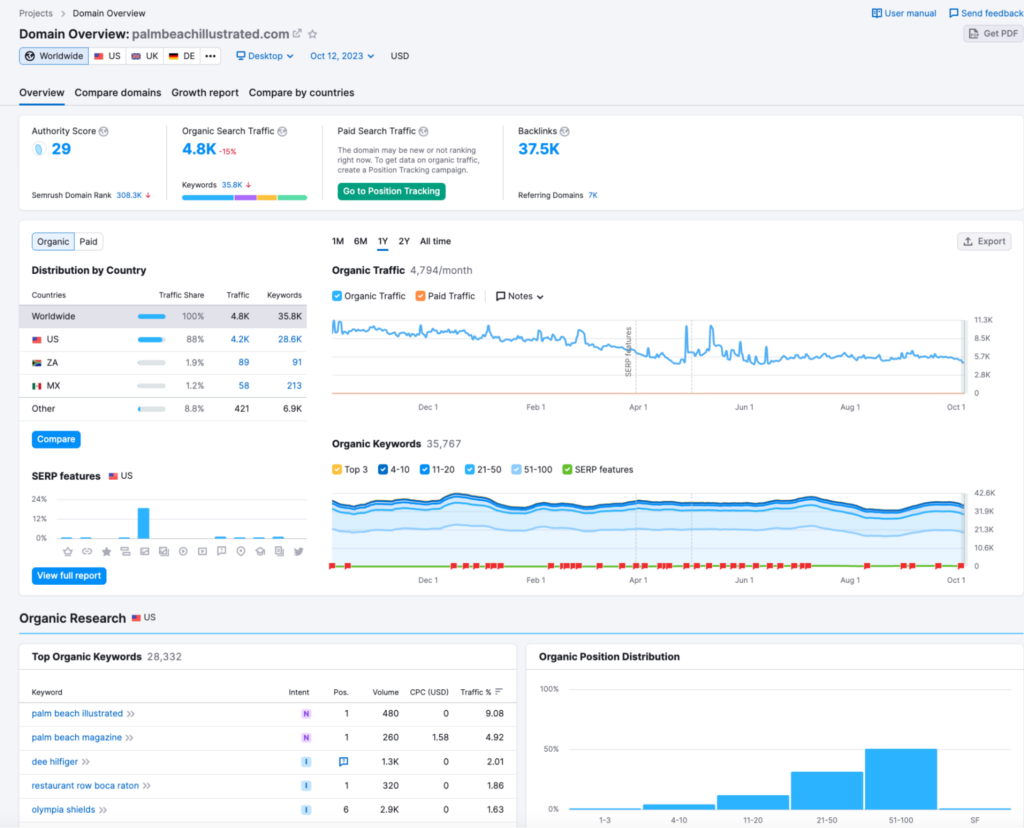

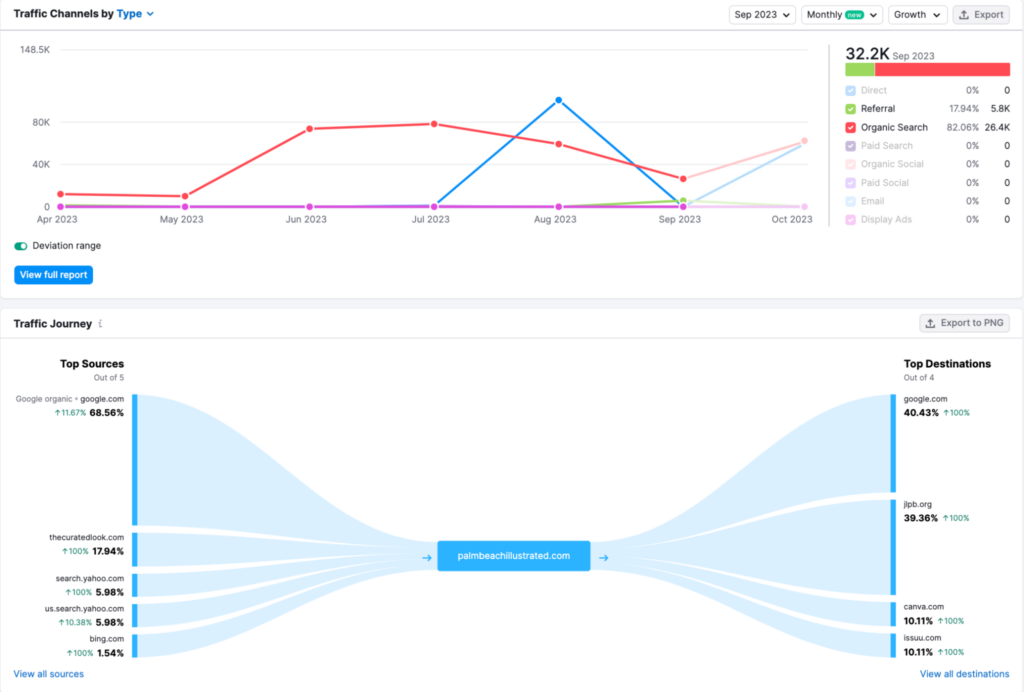

Palm Beach Illustrated has — as expected — a very unique audience profile…

- More than half of all visitors arrive via desktop devices

- Top traffic pages are more “lifestyle and entertainment,” less “news to know”

- A much smaller unique visitor footprint, for a more niche segment of the market

…as their search traffic goes, so too they seem to go…

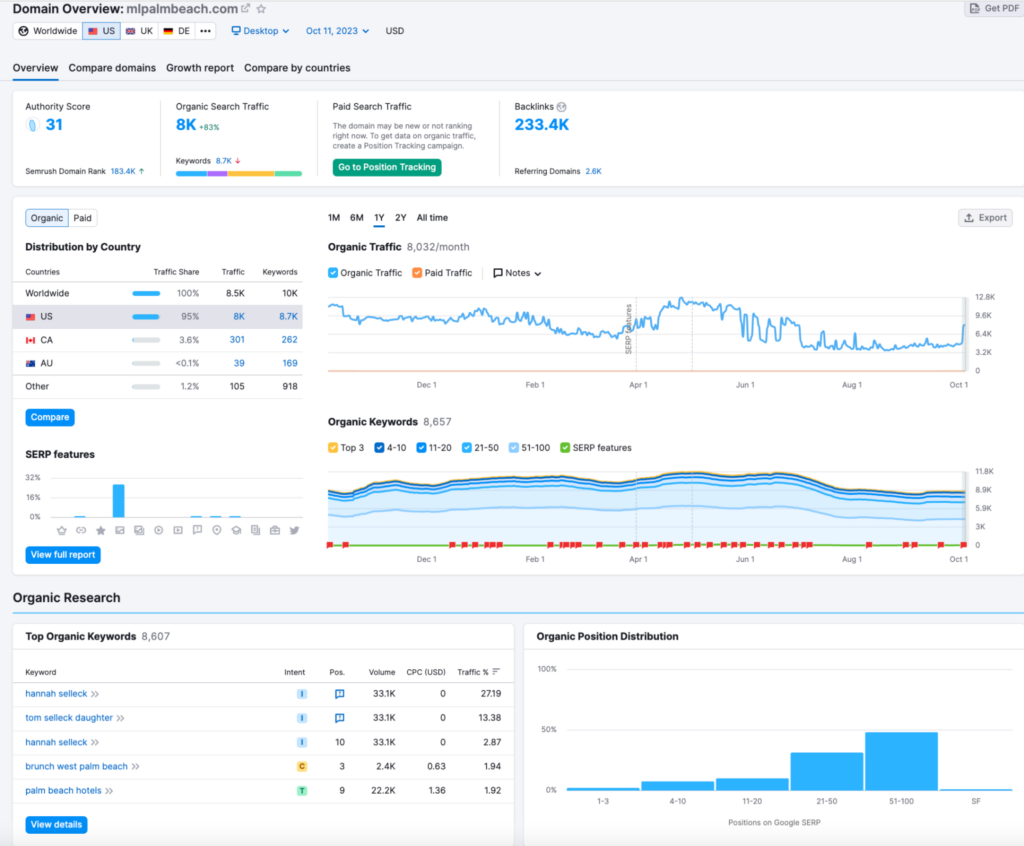

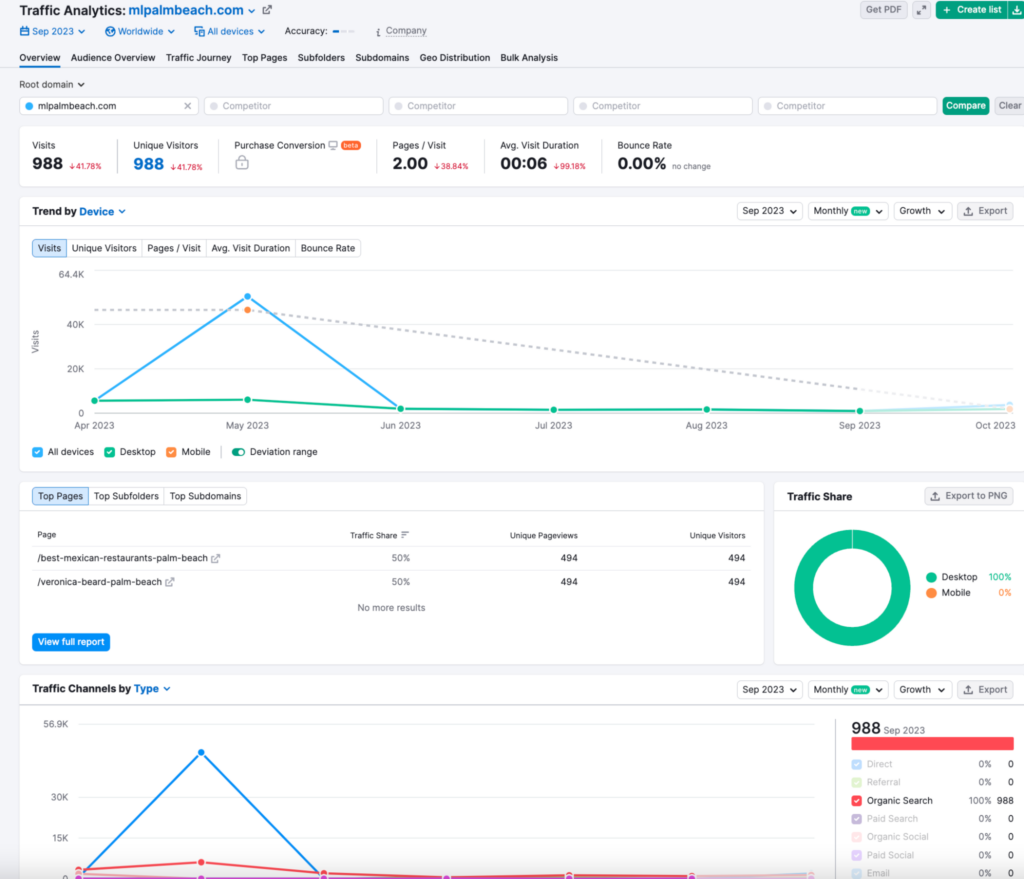

ML Palm Beach

- Fluctuating traffic, but many more ways to attract an audience than most others

- People don’t need to know them to find them (positive for new audience growth)

- Their traffic pattern reflects the Palm Beach audience: “Away for the Summer”

CULTURAL TOUCHSTONES

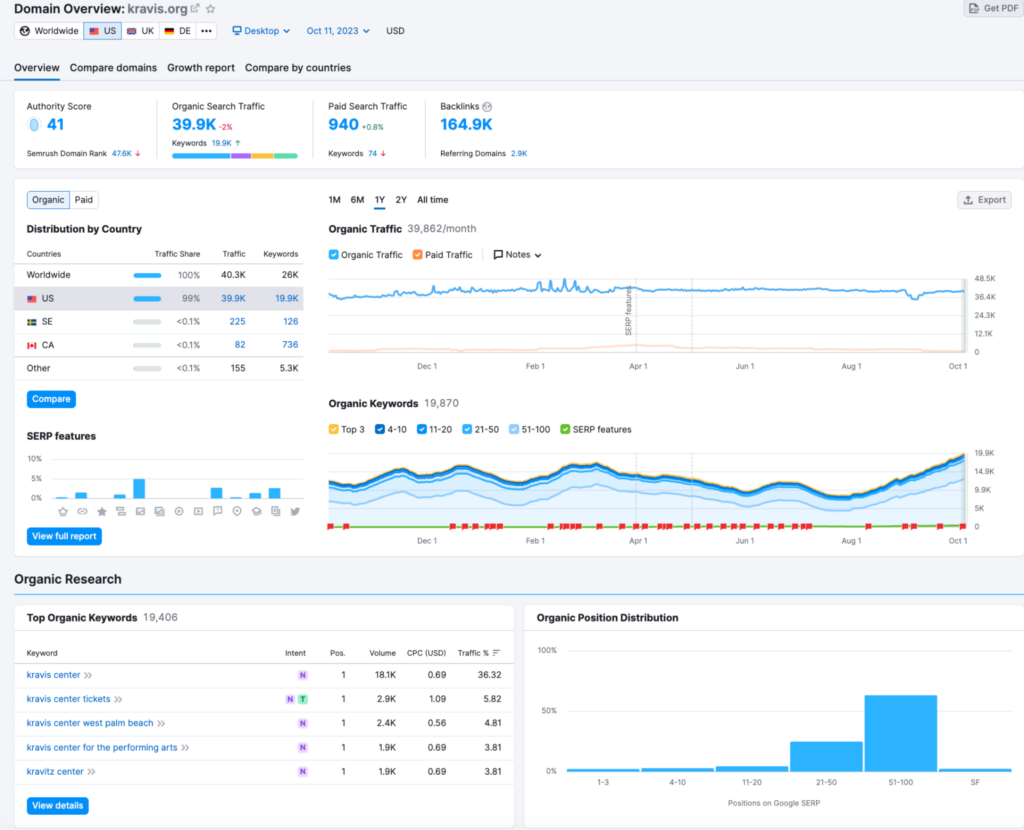

The Kravis Center

- The elephant in the landscape

- Slightly seasonal, but a primarily steady audiemce

- No surprises here: Branded search, and brand loyalty, carry the day

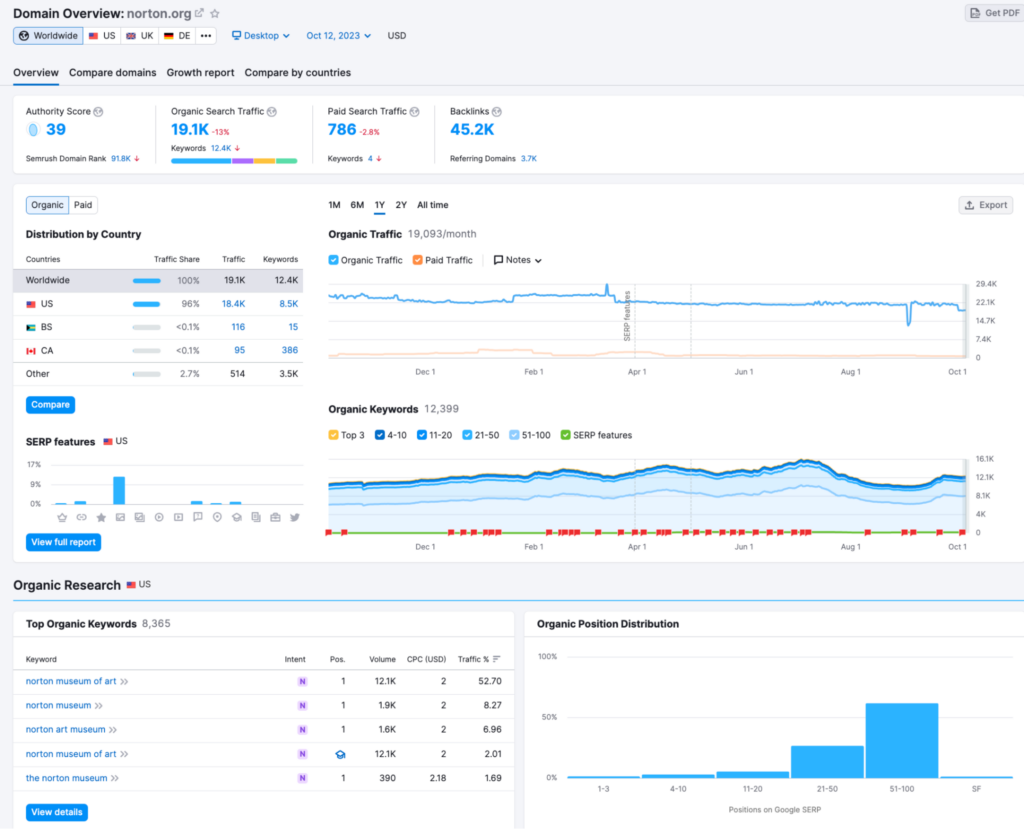

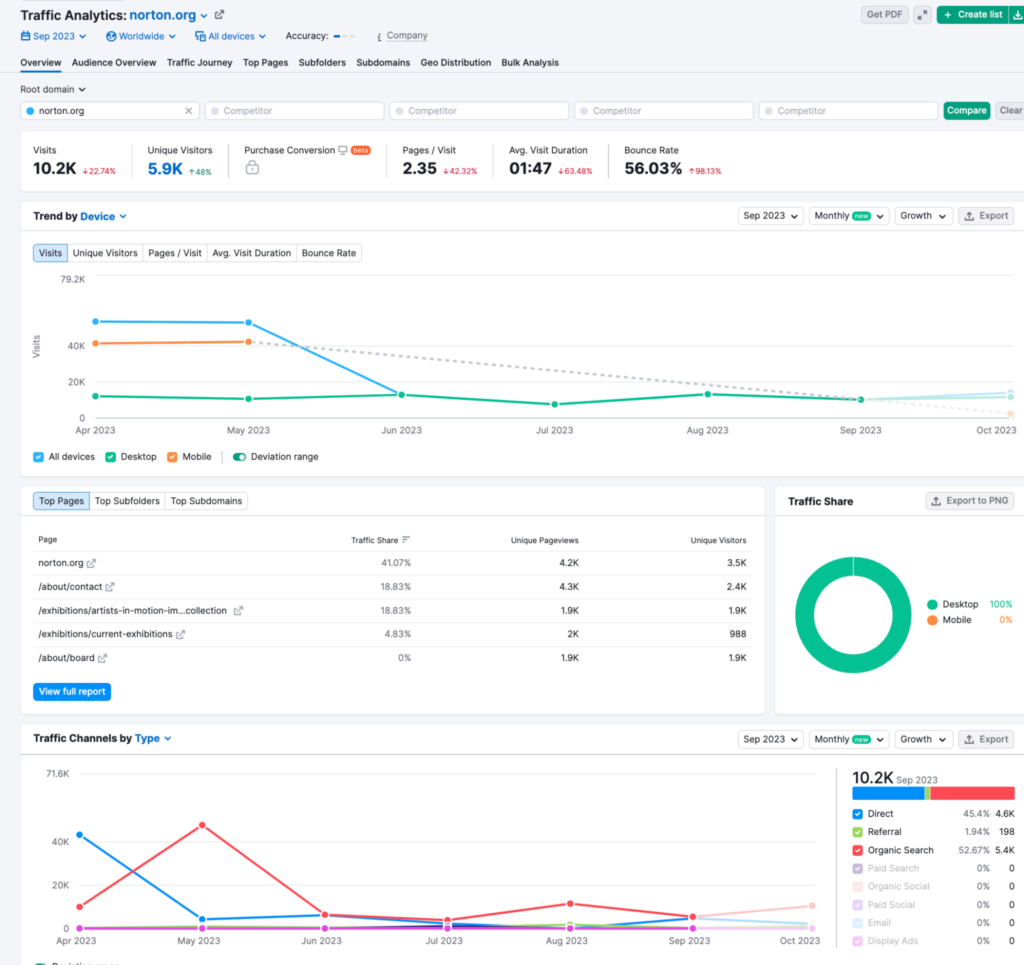

The Norton

- An institution in South Florida art

- Strong branded search presence, but lighter on discovery from new prospects

…summers get slow…

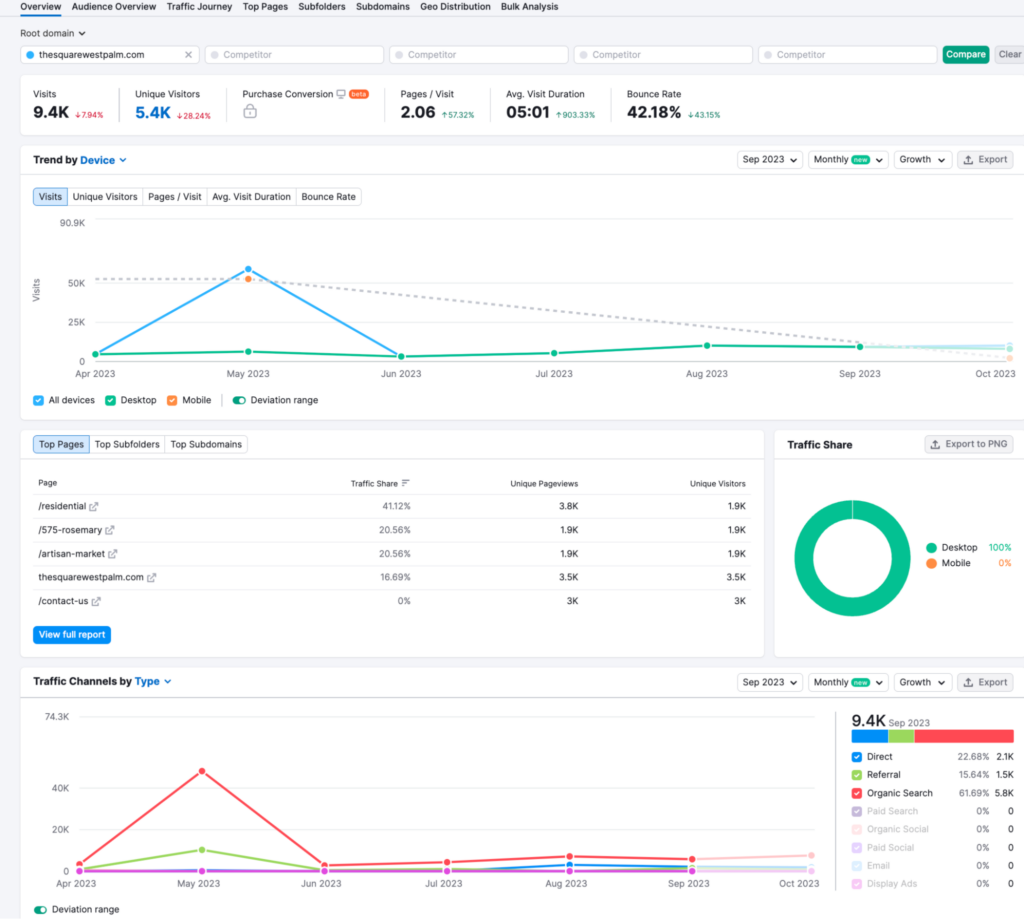

The Square (formerly Rosemary Square, and CityPlace before that)

- A relatively small, but engaged, web audience

- The new and forthcoming projects are driving a significant portion of their traffic

- Organic search is their primarily acquisition channel, indicating strong new audience discovery prospects

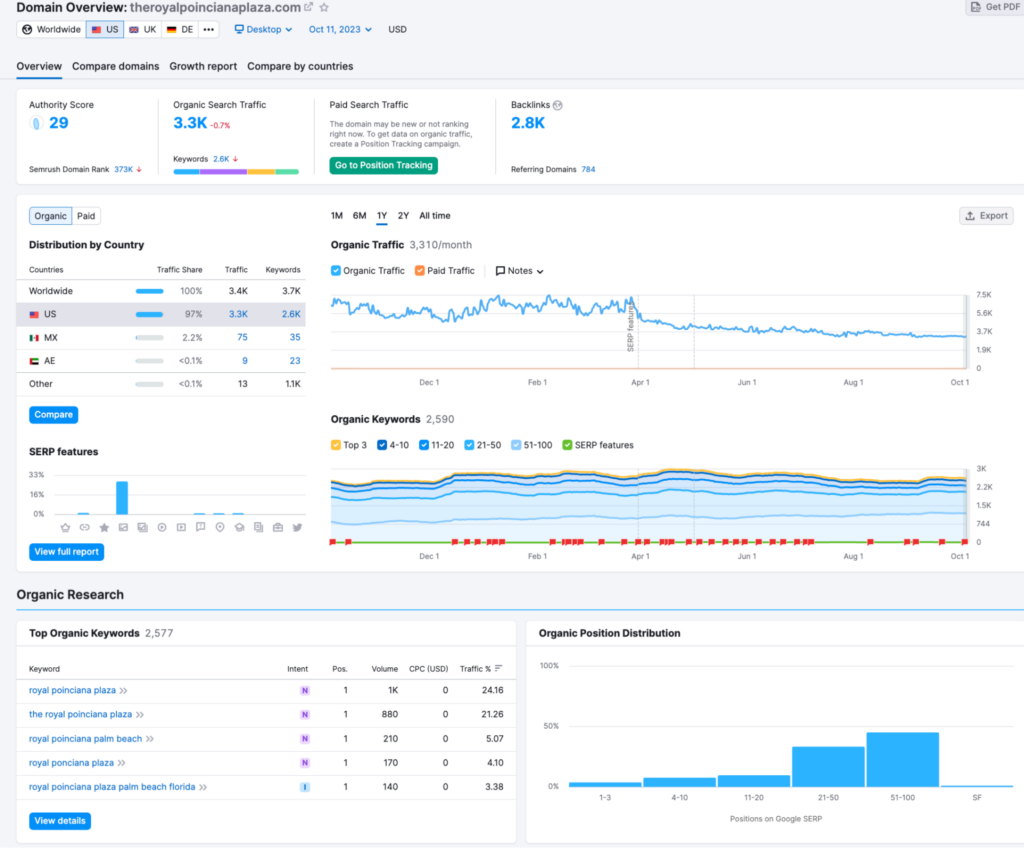

The Royal aka Royal Poinciana Plaza

- IYKYK, but if you don’t…do you even find it online to go?

- See the relatively small organic search traffic

- Their digital footprint prioritizes social media over search

The end…for Now

Using digital data such as this that encompasses all of the area’s leading media, commercial and cultural institutions, our hope is that businesses are able to gain insights/understanding into when, where and how to best engage with specific segments of the consumer audience compromising the West Palm Beach DMA .

We also hope this will help business leaders gain some unique perspective into what this valuable audience has recently been most responsive to online. While there’s much more to still cover, we believe this initial data collection will help marketers unlock new value by capitalizing on big picture habits and trends. Stay tuned…

Want to discuss the meaning of this data in more detail with us? Book a call here.