Work That Fuels Growth

After seeing our creative, consumers stated they were 56% more likely to buy from our clients.

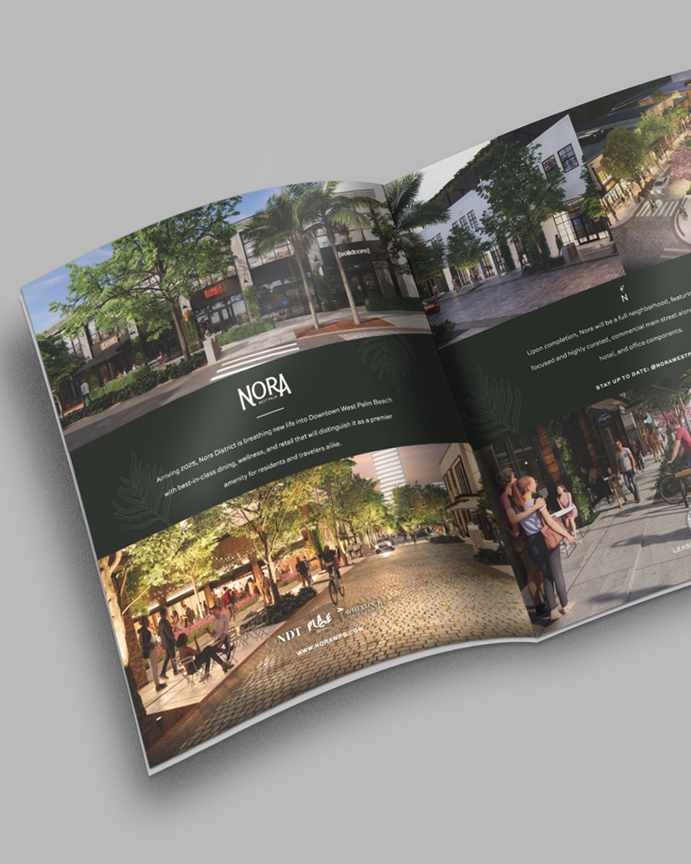

The Nora District / Nora West Palm

ER Bradley’s Saloon: A Local Legend, Modernized

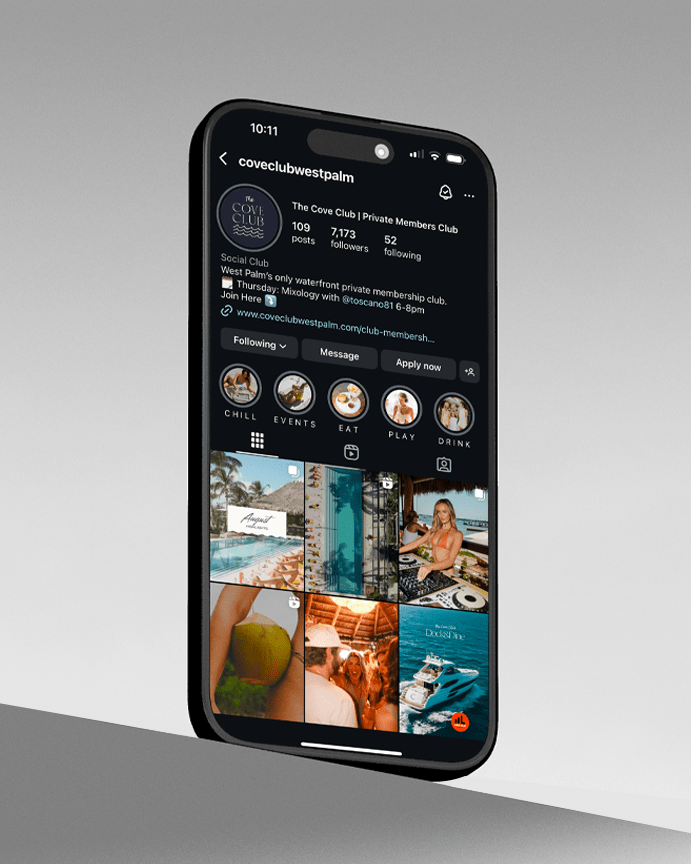

Cove Club

Multicultural Marketing Capabilities | Premium Brand & Consumer Strategies

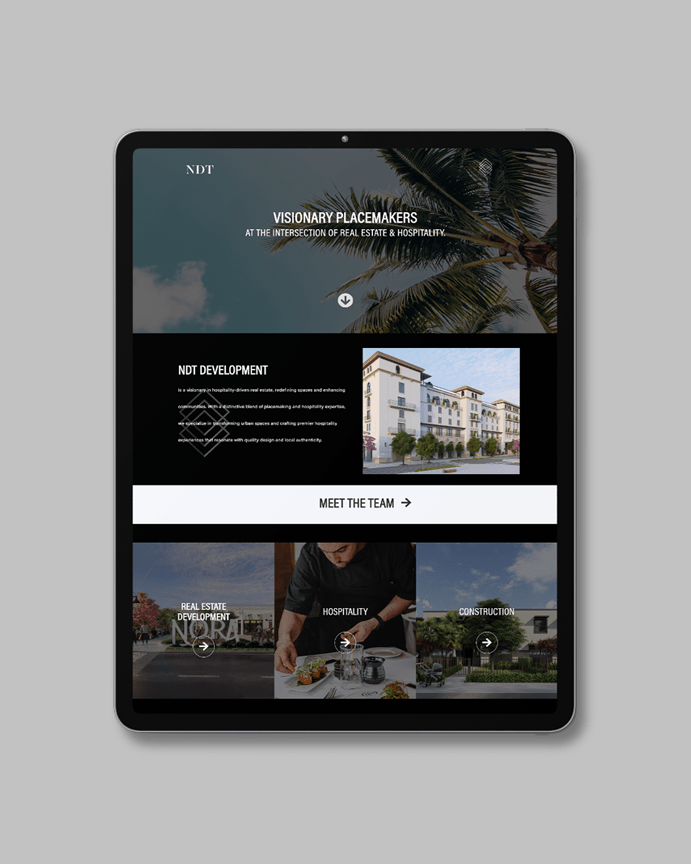

NDT Development

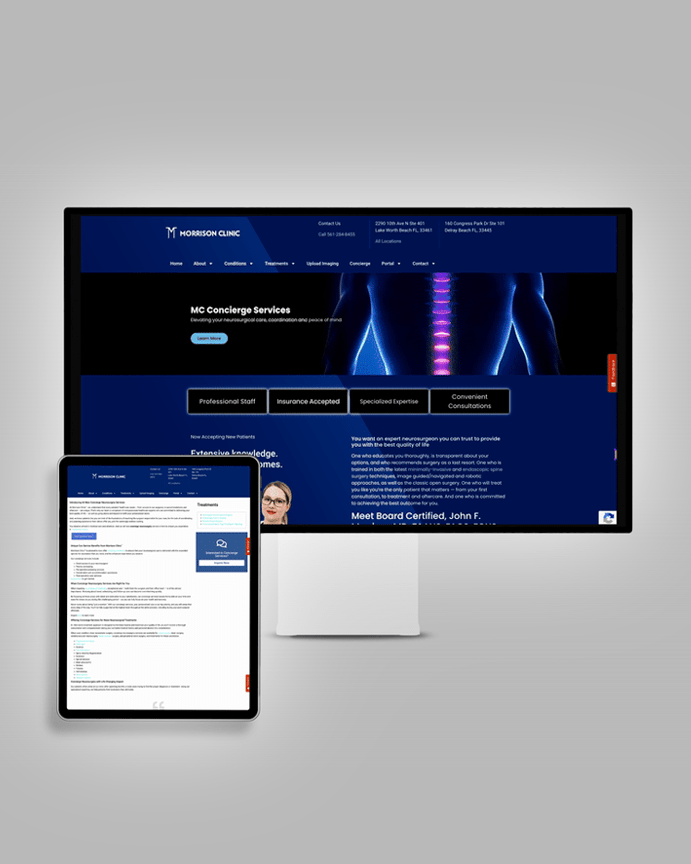

Morrison Clinic

Lamarina Restaurant

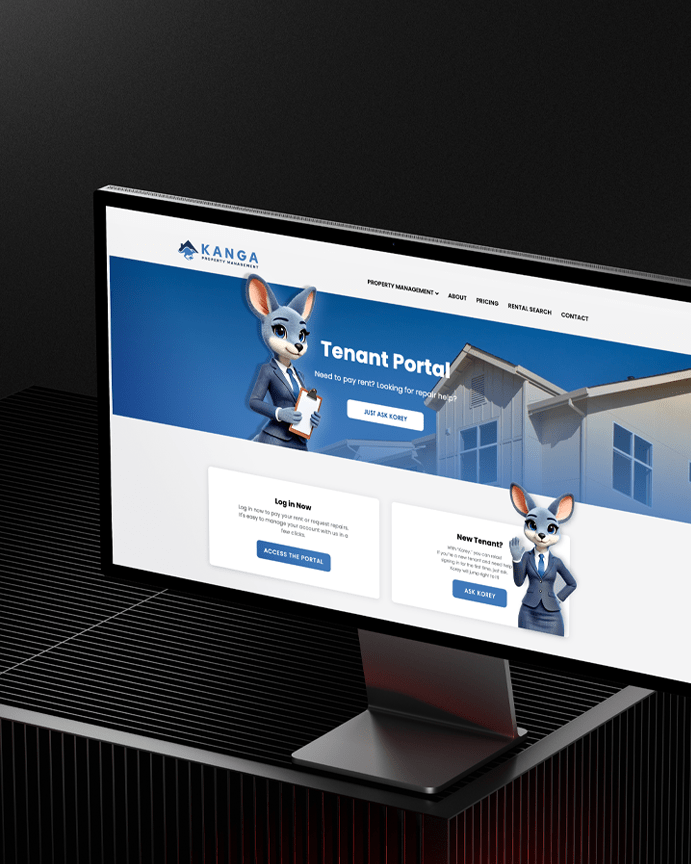

Kanga Property Management

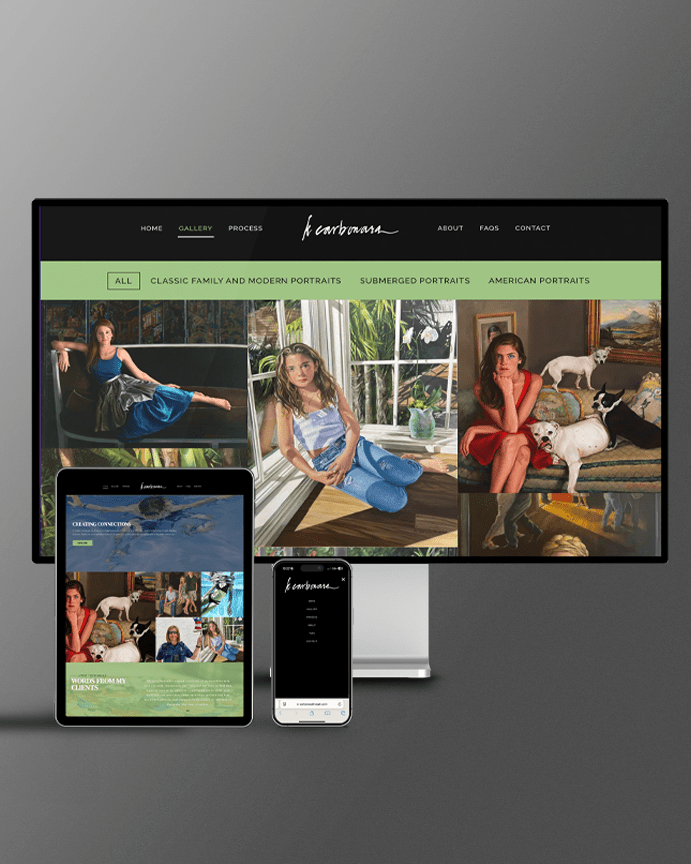

Kathleen Carbonara

Ethan Todd

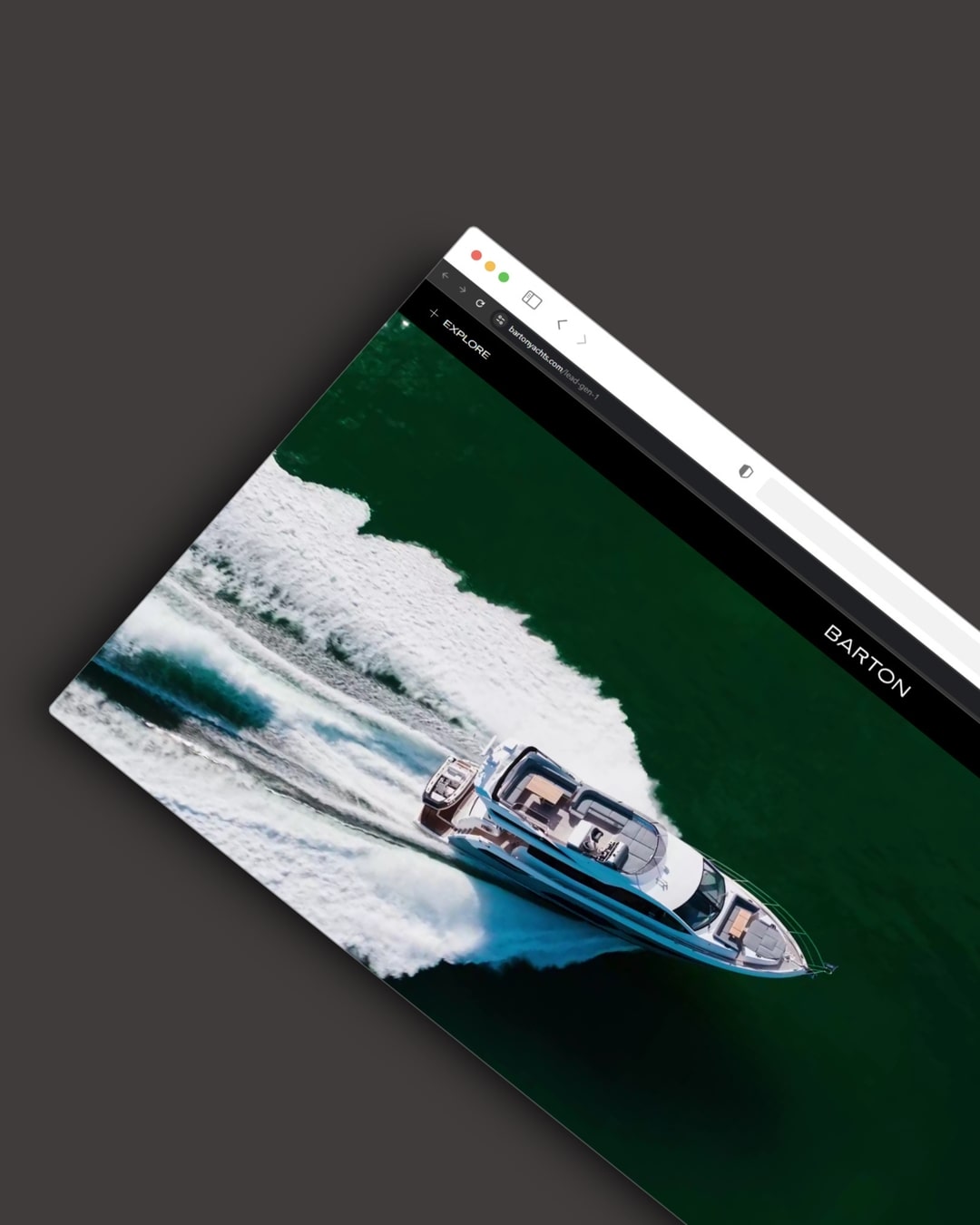

Barton Yachts

Leadership Business Council

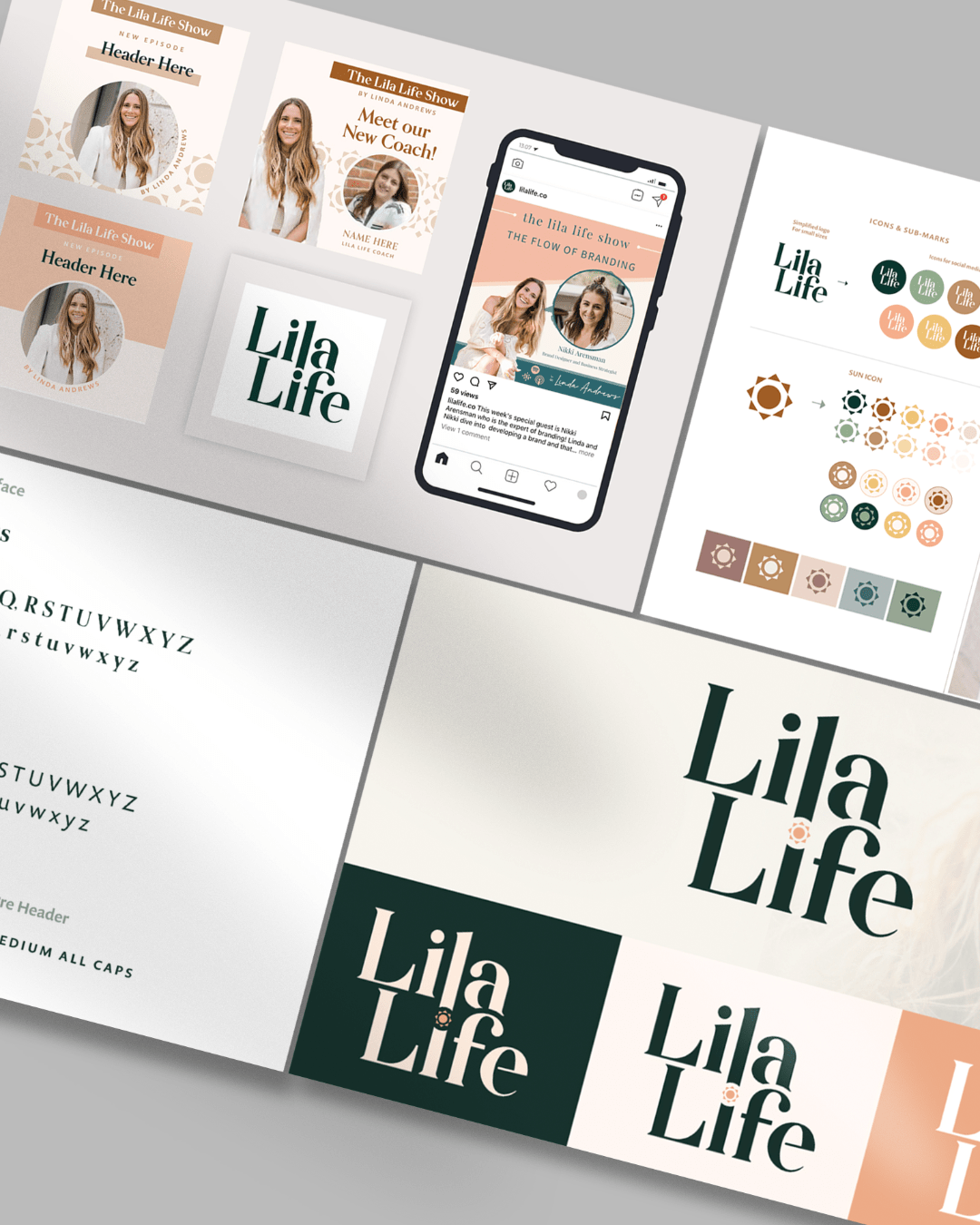

Lila Life